IRA Withdrawal Planning Can Save on Taxes

Article Highlights:

- Early Distributions

- Distributions After Age 59½

- Minimum Required Distributions After Age 72

- Excess Accumulation Penalty

- Estate Tax Issues

Early Distributions (before 59½) - If funds are withdrawn before the taxpayer reaches age 59½, the distribution is subject to a 10% early withdrawal penalty (and state penalties, if applicable) in addition to income taxes, unless what is referred to as the substantially equal payment exemption is utilized. Under this exception, an early retiree can begin taking substantially equal payments at least once a year over their projected lifetime or the joint lives of themself and a designated beneficiary. The payments must not cease before the end of a five-year period beginning with the date of the first payment AND must continue until after the taxpayer reaches age 59½.

Age 59½ to age 72 Distributions – After attaining age 59½, an individual can take funds out of their IRA in whatever amount they wish in any year until reaching age 72. This withdrawal flexibility leaves the retiree to plan their distributions to minimize taxes. Techniques involve matching distributions with no- or low-income years.

Age 72 and Older – Once a taxpayer reaches age 72, they must withdraw at least a minimum amount from their Traditional IRA each year. A taxpayer who fails to take the required minimum distribution (RMD) in the year age 72 is reached can avoid a penalty by taking that distribution no later than April 1st of the following year. However, that means the IRA owner must take two distributions in the following year, one for the year in which they reached age 72 and one for the current year.

When a taxpayer takes distributions that are less than the required minimum distribution for the year, the amount not distributed as required is subject to a 50% excise tax (excess accumulation penalty) for that year. In many cases the excess accumulation penalty can be reduced or totally eliminated by following IRS abatement procedures. Generally, you must show that the failure to take the required distribution was due to reasonable cause and that steps are being taken to remedy the shortfall.

Quite frequently, taxpayers have multiple IRA accounts in addition to one or more types of other retirement plans. This gives rise to a commonly asked question, "Must I take a distribution from each individual account?" For purposes of the annual RMD, a separate distribution must be taken from each type of plan. However, a taxpayer may have multiple accounts for each type of plan, which, for tax purposes, are treated as one plan. For example, if you have three IRA accounts, the three separate accounts are treated as one for tax purposes, and the distribution can be taken from any combination of the accounts.

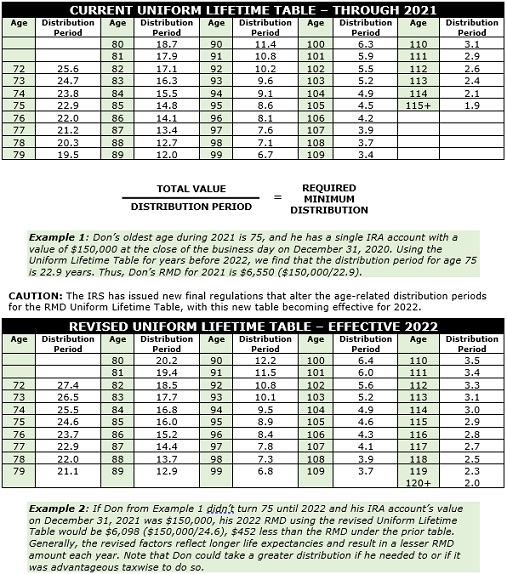

Generally, the minimum amount that must be withdrawn in a particular year, beginning the year a taxpayer reaches age 72, is the total value of all IRA accounts (as determined on December 31st of the prior year) divided by a factor based on the IRA owner’s age. The factor is the estimated remaining life for individuals of that age as determined by the IRS based on longevity studies, and most often, is found in the table below.

Estate and Beneficiary Considerations – When planning your distributions, keep in mind that the value of your undistributed IRA account will be included in your gross estate when you pass on, and depending upon the size of your estate, it may be subject to estate tax. In addition, the inherited IRA distributions will be taxable to the individual who inherits the IRA. Therefore, it could be appropriate for you to utilize your IRA funds first and then dip into other assets after the IRA funds have been depleted. On the other hand, funds left in an IRA do continue to accumulate tax-free, which might be better in certain circumstances. If your spouse is the beneficiary of your IRA, he or she has various options as to holding title to the account and distribution periods, while distribution of the IRA to a non-spouse beneficiary generally will have to be completed no later than ten years after the year of your death.

If you would like assistance with your tax planning needs or to develop an IRA distribution plan, please call this office for an appointment.

More About Us

Get to Know Prestige Accounting Services Group

Offices in Flemington, NJ, and Califon, NJ

Our Mission: At Prestige Accounting Services Group, we are on a mission to redefine the tax experience for individuals and small businesses. With a focus on personalized service, strategic planning, and expert guidance, we aim to empower our clients to succeed financially with confidence and ease.

Expertise in Action: With a wealth of experience and a team of dedicated professionals, we specialize in individual and small business tax preparation. While we excel in all areas of taxation, our passion lies in serving the unique needs of small business owners in New Jersey. We understand that small business taxation requires specialized knowledge and attention to detail, which is why we go above and beyond to ensure our clients receive the guidance and support they deserve.

Tailored Solutions for Every Client: Whether you're a high-net-worth individual seeking comprehensive tax planning or a small business owner in need of accounting and bookkeeping assistance, we have the expertise to meet your needs. Our team takes the time to understand your specific situation and develop customized solutions that align with your goals and objectives.

Why Choose Us?: What sets us apart from other New Jersey tax firms is our commitment to excellence and innovation in the field of taxation. We don't just prepare tax returns; we provide strategic insights, proactive planning, and actionable advice to help our clients achieve their financial goals. With a team of two CPAs, an EA, and an ERO, we have the expertise and resources to deliver exceptional service and results.

Your Success is Our Priority: At Prestige Accounting Services Group, we measure our success by the success of our clients. We are dedicated to building long-lasting relationships, providing unparalleled service, and helping our clients thrive in today's ever-changing tax landscape.

We can't wait for you to experience the Prestige Accounting Services Group difference.

Tax & Small Business Updates

Get the latest in tax and small business updates and issues that affect your finances and growth prospects.